- 回首頁

HOME - 出納組

Cashier - 外僑所得扣繳專區

Withholding Tax for Foreign Nationals

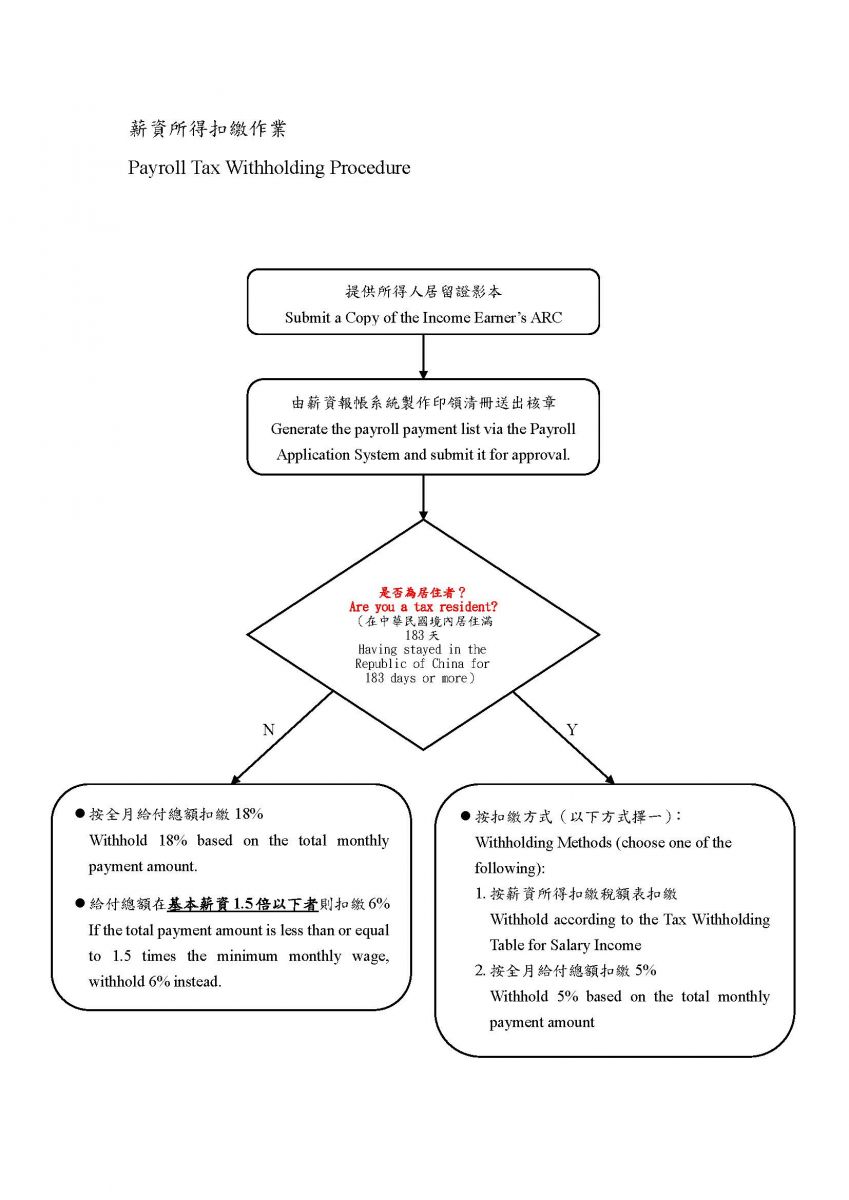

壹、薪資所得扣繳的程序

貳 、外僑稅務常見問題Q&A

下列兩種人是屬於「中華民國境內居住之個人」:

一、在中華民國境內有住所,並經常居住中華民國境內,無論於一課稅年度內居住有無滿183天者。

二、在中華民國境內無住所,而於一課稅年度內在中華民國境內居留合計滿183天以上者。

不屬於前2項所稱的個人,即為「非中華民國境內居住之個人」。

If you meet any of the following criteria, you are considered a resident of the Republic of China:

1. A person who has domicile within the territory of the Republic of China and resides at all times within the territory of the Republic of China

2. A person who has no domicile within the territory of the Republic of China but resides within the territory of the Republic of China for a period of more than 183 days during a taxable year

If you do not meet either of these criteria, you are a non-resident of the Republic of China.

自一月一日起至同年十二月三十一日止為一課稅年度。

A tax year in Taiwan is the same as the calendar year. It starts from January 1 and concludes on December 31.

外僑在華居留日數係以護照入出境簽章日期 為準(始日不計末日計),如一課稅年度內入出境多次者,累積計算。

The length of your stay in Taiwan is calculated using the border entry/exit stamps in your passport (exclusive of the entry date but inclusive of the exit date). If an individual enters and leaves Taiwan multiple times in a year, the length of each stay is added together to calculate the total days of presence.

依外僑居留證所載之居留期間判斷「居住者」或「非居住者」。預計一課稅年度可居留滿183天者,即按居住者之扣繳率扣繳。如離境不再來我國時,其於一課稅年度在我國境內實際居留天數合計不滿183天者,再依「非居住者」扣繳率核計其扣繳稅額,就其與原扣繳稅額之差額補扣。

We first determine your resident status based on the length of stay indicated on your alien resident certificate (ARC). Those who are expected to reside in Taiwan for 183 days or more in the current tax year will be subject to the withholding rate applicable to residents. If you decide to leave Taiwan early without re-entering, thus making your length of stay in the current tax year fall below 183 days, we will recalculate the payable tax based on the nonresident rate and then process the difference.

| 所得類別 | 居住者 | 非居住者 |

| 薪資 | 5% | 18%—但全月薪資給付總額基本工資1.5倍(114年度為42,885元)以下6%。 |

| 執行業務所得 | 10% | 20%—但個人稿費、 版稅、樂譜、作曲、編劇、漫畫、講演之鐘點費之收入, 每次給付額不超過新臺幣5仟元者,得免予扣繳。 |

| 租金 | 10% | 20% |

| 權利金 | 10% | 20% |

| 競技競賽機會中獎之獎金或給與 | 10% | 20% |

| Income type | Resident | Nonresident |

| Salary | 5% | 18% For monthly income equal to or less than 1.5 times the minimum wage [NT$42,885 in 2025], the 6% withholding rate applies. |

| Income from professional services | 10% | 20% Author's fee, royalties, sheet music writing, music composition, script writing, comic books, and hourly lecture fees are exempt from tax withholding if the payment is no greater than NT$5,000. |

| Rent income | 10% | 20% |

| Royalties | 10% | 20% |

| Income from contests and games and from prizes and awards won by chance |

10% | 20% |

一、有配發統一證號:填寫統一證號。

二、無統一證號:

(一)大陸人士:第1位填9,第2至第7位填西元出生年後2位及月、日各2位, 第8位至第10位空白。

(二)其他外僑:前8位採護照內之西元出生年、月、日,後2位採護照內英文姓名第1個字之前2位字母。

1. If you have a national ID number, it is also your uniform identification number.

2. If you do not have a national ID number:

1) Individuals from mainland China:

The first digit of your uniform identification number is always 9.

The 2nd-7th digits are your date of birth in YYMMDD format (where 'YY' is the last two digits of your birth year). Leave the 8th-10th digits blank.

2) Individuals from other countries:

The first eight digits are your date of birth in YYYYMMDD format.

The last two digits are the first two letters of your name as it appears on your passport (no matter whether it is your given name or family name, use the first two letters of the name that is printed first in the 'name' section).

申報時應攜帶居留及所得相關之證明文件, 例如護照、居留證、扣繳憑單、受扶養親屬資料……等。

You will need documents that prove your residency (or non-resident) status, your income, and your eligibility for tax waivers. These include your passport, alien resident certificate, withholding/non-withholding tax statements, identification documents for dependent family members, etc.

在臺居留日數滿183天而尚未離境者,應於次年度5月1日起至5月31日止,辦理上年度之結算申報。

但若於年度中途離境者,則應於離境前10天內,向居留證所載居留地址所在地之國稅局,辦理當年度申報。

If you are still present in Taiwan and your length of stay here reached 183 days in the previous tax year, you should file between May 1 and May 31 in the current year.

If you are leaving Taiwan before the conclusion of a tax year, you should file in person at the local tax office (based on the place of residence indicated on your ARC) at least 10 days prior to your scheduled departure.